OnlyFans Taxes: Everything You Must Know

You're making money on OnlyFans! That's a big deal that you've turned your content into a business. But with that success comes taxes, which is a bummer.

You're not the only one who gets scared or thinks of scary letters from HMRC or the IRS when you hear the word tax.

A lot of creators feel like they don't know what to do at first. But don't worry, you won't be caught off guard when it comes to figuring out how your OnlyFans income is taxed, what you can write off, and how to keep more of what you make without worrying about it.

This guide will walk you through how OnlyFans income is taxed, expenses that can be deducted, and common mistakes that can be avoided.

So, shall we?

How OnlyFans Income is Taxed

First things first, let's talk about how the government sees your OnlyFans earnings. It's not like a regular 9-to-5 job, and that changes a few things. The money you make from your subscribers, tips, and pay-per-view content is all considered taxable income.

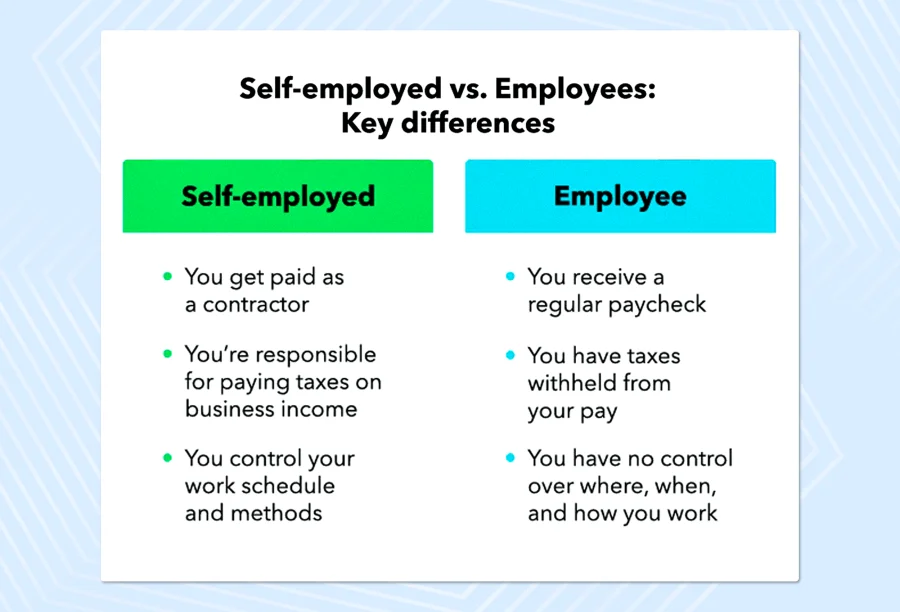

You're Considered Self-Employed

This is the most important thing to know. You are not an employee of OnlyFans if you create content for them. You are in charge of your own OnlyFans business.

This means that you are now officially self-employed. It's great to be self-employed because you get to be your own boss, but you also have to take care of your own taxes. Your employer won't take taxes out of your pay cheque. You are responsible for telling HMRC (or the IRS) about your income and paying what you owe.

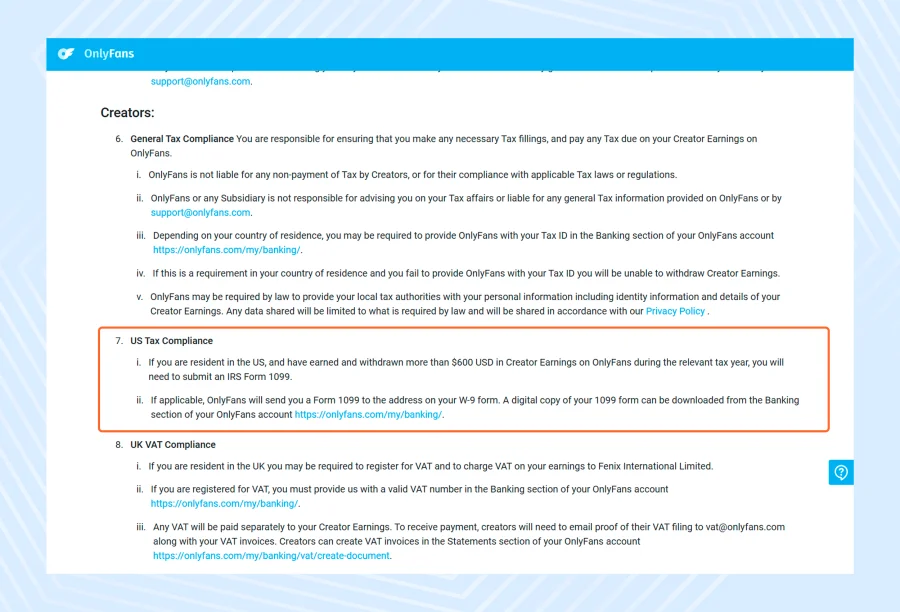

1099-NEC and Tax Reporting

If you live in the US and make more than $600 a year from OnlyFans, they will send you a 1099-NEC form. This is like a report card for how much money you make. OnlyFans sends you one copy and the IRS another. Yes, they do know how much money you made.

But here's the most important thing: you still have to report all of your OnlyFans income, even if you make less than $600 and don't get a 1099-NEC. Every dollar. If you don't pay attention to this, it's considered undeclared income, which can get you in a lot of trouble. It's very clear in the tax laws.

Federal and State Taxes

As a self-employed individual in the US, you usually have to pay taxes at two levels. First, there is the federal income tax. This is the tax that everyone pays on their income. Second, you have to pay self-employment taxes.

This tax pays for your Medicare and Social Security contributions. If you work for someone else, they pay half of this. But since you're the boss, you have to pay the entire amount.

This will cost you 15.3% of your net income. Most states also have their own income tax, so you'll need to look up the tax laws in your state.

Quarterly Estimated Tax Payments

This is a big one, okay? You can't just wait until April to pay your whole year's taxes because no one is taking taxes out of your OnlyFans payments. If you do, you'll probably have to pay a lot of money and face penalties. You should make estimated tax payments every three months instead.

This basically means figuring out how much money you'll make and spend in a year, how much tax you'll owe, and then sending the IRS payments four times a year, usually in April, June, September, and January. This is an important part of planning your taxes. It keeps you from facing a large tax bill and helps you stay in good standing.

What Expenses Can You Deduct?

Since you own a business, you can deduct your business costs. When you deduct an expense, you can subtract the cost of that expense from your total earnings.

This lowers your taxable income, which in turn lowers the amount of tax you owe. The most important rule is that an expense has to be "ordinary and necessary" for your OnlyFans business. Let's talk about some of the most common ones.

Expenses 1: Internet and Phone Bills

You can't run an OnlyFans without being online, can you? You can definitely write off your internet bill. The same goes for your phone bill, especially if you use it to promote your OnlyFans account, make videos, or talk to fans.

What's the catch? You can only deduct the part you use for work. If you use your phone for your OnlyFans content half the time, you can deduct half of your phone bill.

Expenses 2: Equipment and Lighting

You can write off the new camera, the ring light that makes you look great, the laptop you use to edit, and the microphone for clear audio. If you buy equipment just to make content for your business, it's a business expense. Don't forget to keep your receipts! This is a great way to lower your taxes.

Expenses 3: Makeup, Clothing, and Props

This one might be a little tricky. You can write off the cost of makeup, lingerie, costumes, and props that you buy exclusively for your job as a content creator.

If you buy a dress for a photo shoot and never wear it outside of your content creation, that's a business expense. But if you wear it out with friends too, you can't deduct it. For tax purposes, the item must be used exclusively for your OnlyFans content.

Expenses 4: Home Office Deductions

Is there a certain room or area in your house that you exclusively use for your OnlyFans work? You might be able to take the home office deduction. This allows you to deduct a portion of your rent or mortgage interest, utilities, and homeowner's insurance.

The space must be used "exclusively and regularly" for your business to qualify. This is one of the more complex deductions, so you might want to consult a tax professional before you claim it.

Between, you might want to have a look at some of the best alternatives to OnlyFans if the taxes on the platform just don’t sit well with you.

Filing Taxes as an OnlyFans Creator

Okay, so you understand the basics. Now, how do you actually go about filing your tax return? Being organised is everything. It will make the process smoother and help ensure you are in full compliance with tax laws.

Tax 1: Keep Detailed Records

I can't say this enough. You need to keep track of all the money you make on OnlyFans and all the money you spend on your business. Use a notebook or make a spreadsheet. Write down the date, the amount, and what it was for. There is no way to change this. If the tax authorities ever have questions, having good records is your best defence.

Tax 2: Work with a Tax Professional

The best tax advice I can give you is to ask someone for help. Find an accountant who works with OnlyFans creators or a tax professional who knows how to work with creators and people who are self-employed.

They will help you figure out your taxes, find all the deductions you can take, and make sure you file your taxes correctly. You can often save the money you spend on a good accountant by using their tax efficiency, and their fees are usually tax-deductible as well! They can give you important advice on your tax journey.

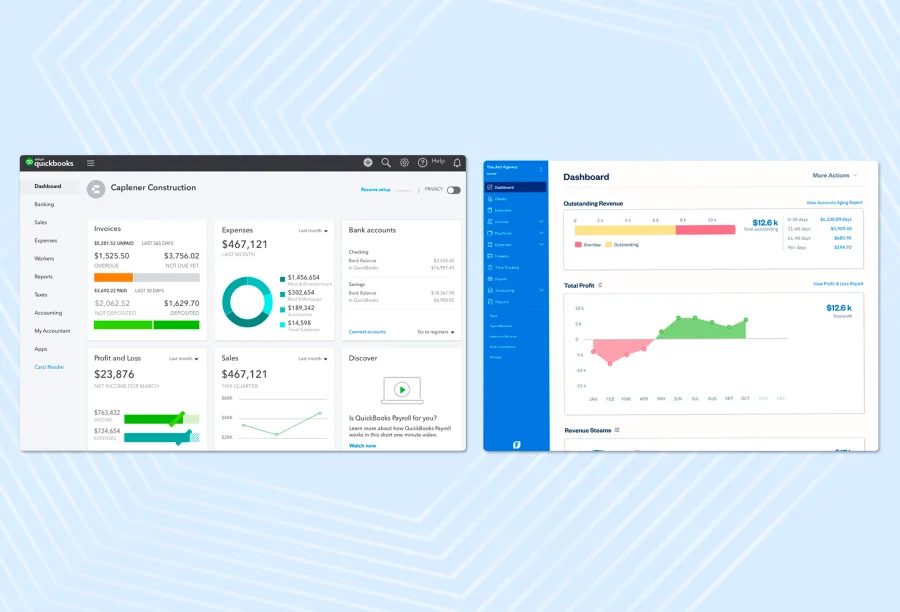

Tax 3: Use Accounting Software

If you want to do more than just use a spreadsheet, you could try accounting software like QuickBooks Self-Employed or FreshBooks. These tools can connect to your bank account, help you keep track of your income and expenses, keep track of your mileage, and even help you figure out how much you owe in taxes every three months. It makes it much easier to plan your taxes.

Tax 4: Track Income and Expenses Regularly

Don't wait until the last minute to go through all of your receipts for the year before you file your self-assessment tax return. Once a week or a month, set aside some time to update your records.

This habit will help you avoid a lot of problems and make sure you always know how much money your OnlyFans business has. This is important for keeping your taxes in check.

Common Tax Mistakes to Avoid

A lot of creators make the same mistakes when they're starting out. Knowing what they are can help you avoid them and save you a lot of stress and money. Let's look at the biggest ones.

Mistake #1: Ignoring Quarterly Taxes

I'm bringing this up again because it's so important. A lot of new creators don't know about the taxes that are due every three months. They get a big tax bill after they file their first tax return, and they have to pay extra for not paying their taxes all year. Don't let this happen to you. You really need to pay these estimated taxes.

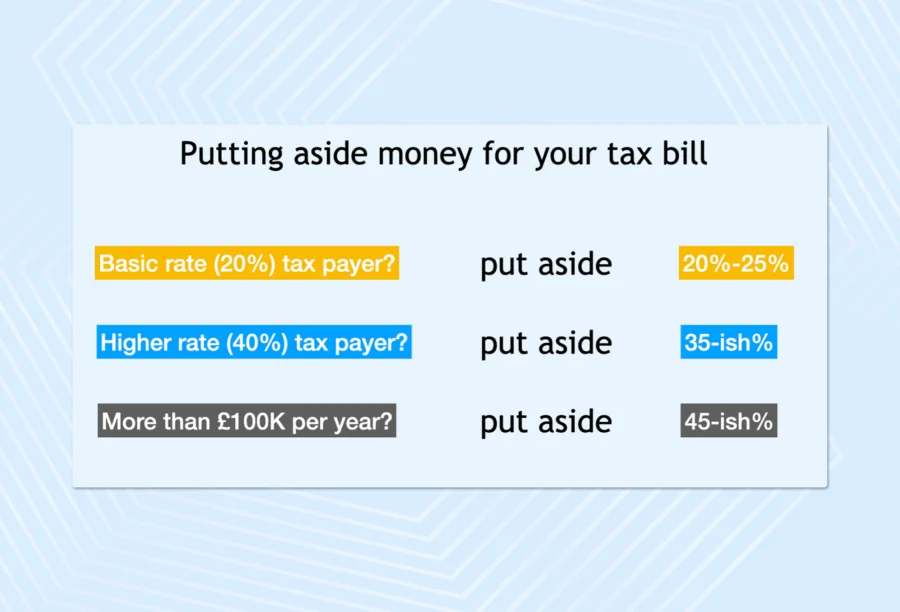

Mistake #2: Not Saving for Tax Time

It's hard not to spend the money that comes from OnlyFans when you see it in your account. But keep in mind that some of that money isn't really yours; it's the taxman's. A good rule of thumb is to put 25–30% of every payment you get into a separate savings account right away. This way, you will have the money when you need to pay taxes.

Mistake #3: Mixing Business and Personal Finances

Please open a separate bank account for your OnlyFans income and expenses. It makes it a lot easier to keep track of everything. It's hard to tell what was a business expense and what was just for you when you mix your business and personal finances. This is a big red flag for tax authorities and could make any tax issues even harder to deal with.

Mistake #4: Not Reporting Tips or Gifts

Many people think that tips or money sent through a wishlist aren't taxable. That's not right. Any money you make as a creator is considered income. This includes direct tips on sites like OnlyFans, payments through cash apps, or the value of things bought from an Amazon wish list. If you don't report this, you could be committing tax fraud.

Is OnlyFans Taxed Differently Than Other Jobs?

Yes and no. The tax laws around income are generally the same, but the way you interact with the tax system is very different from a traditional employee. The tax implications stem from your employment status.

You're a Business Owner, Not an Employee

This is the main difference. Your employer takes care of a lot of the tax stuff for you when you're an employee. You are both the boss and the worker when you make content for OnlyFans.

This means you have to do more things, like keep track of your own income and expenses and pay your own self-employment taxes. The government sees your OnlyFans work as a real business.

No Withholding From Payments

When you receive payment from OnlyFans, it is your gross earnings for that period, after deducting the 20% platform fee. No tax or National Insurance has been deducted; this may be a massive mental and financial shift from receiving a net salary.

You are now responsible for calculating and allocating the money you need to cover your future tax bill. A common procedure is to open a second bank account for saving tax. For every payment received, you can transfer a set percentage (for example, 25-30%) to your tax savings account. This way, your tax is saved and ready for payment when it's due.

This is essential due to how the self-assessment system works. Self-assessment often includes payments on account. If your Self Assessment tax bill is over £1,000 and there was less than 80% deducted at source (which will always be the case with a full-time creator), HMRC will require you to make payments on account towards your tax bill for the next period. There are two payments due as follows:

January: You pay your balancing payment for the previous year, PLUS your first payment on account for the current year.

July: You pay your second payment on account.

Different Rules for International Creators

The US tax system has been the main topic of this guide. However, if you manufacture products outside the US, you must register with your country's tax office and comply with its regulations.

If you're in the UK, for instance, you'll have to deal with HMRC and may need to think about Value Added Tax (VAT) if your income goes over a certain amount. Some creators even start a business and have to pay corporation tax.

International tax rules can be hard to understand, so it's important to talk to a qualified tax professional in your country. You still have to file US taxes even if you are a US citizen living outside the US.

Safety Tips for Managing OnlyFans Finances

Beyond just taxes, managing your money safely is super important. You're handling your finances online, so you need to be smart about it.

1. Separate Business Bank Account

It's a safety tip, and I've said it before. Keeping your OnlyFans business money separate from your personal money keeps your personal money safe. Your personal savings won't be affected if your business ever has a money problem.

2. Use Payment Platforms That Track Income

OnlyFans does a good job of showing you how much money you've made. Use the statements and dashboards they give you. These are your main records. This makes sure you tell HMRC (or the IRS) the right amount of income.

3. Keep Screenshots of Payouts

Things can go wrong with technology. Taking screenshots of your earnings dashboard and payout confirmations on a regular basis is a good idea. Think of it as a backup for yourself. Put them in a safe folder on your computer or in the cloud.

4. Use Secure Devices for Financial Info

Be careful where you get your financial information. Make sure the antivirus software on your computer or phone is up to date. Don't use public Wi-Fi to do your banking or check your OnlyFans earnings. Keep your passwords safe and use two-factor authentication whenever you can.

PS: We’re writing a really detailed blog on how to get tips on OnlyFans. You might want to check that out.

FAQ: About OnlyFans and Taxes

Let's quickly answer some of the most common questions creators have.

What tax forms do I need for OnlyFans?

In the US, you'll mostly use Schedule C ("Profit or Loss from Business") to list your income and deduct your expenses, and Schedule SE ("Self-Employment Tax"). You send in both of these with your main Form 1040 tax return. If you make more than $600 on sites like OnlyFans, you'll get a Form 1099-NEC.

Can I write off my OnlyFans expenses?

Yes, for sure! You can write off any cost that is "ordinary and necessary" for your business. This is one of the best ways to lower the amount of money you owe in taxes. Just make sure you keep good records.

What happens if I don’t report OnlyFans income?

This is a very bad idea. People think it's tax fraud. If you get caught, you'll have to pay a lot of money in back taxes, plus penalties and interest on the unpaid taxes. In really bad cases of undeclared income, it could even lead to jail time. It's not worth the risk.

How do I pay taxes if OnlyFans doesn’t withhold anything?

You pay them directly to the government. Making estimated quarterly tax payments throughout the year is the main way to do this. Then, when you file your annual self-assessment tax return, you'll pay off any balance you still owe or get a refund if you paid too much.

Is OnlyFans’ income taxable worldwide?

Yes, most of the time. Most countries tax their citizens on all of their income, no matter where it comes from. No matter where your subscribers are from, the money you make from them is usually taxable in the country where you live and pay taxes.

It's best to talk to a tax professional if you make money on OnlyFans from all over the world because international tax rules are hard to understand.

Conclusion

At first, the world of OnlyFans taxes and your tax obligations may seem like a maze, but it's really just a matter of knowing that you're self-employed, keeping track of all your income and expenses, deducting all of your legitimate business expenses to lower your tax bill, and making sure you pay your taxes on time every three months.

Keep in mind that you are not only a content creator; you are also a business owner. And smart business owners pay attention to their money. This makes sure that there are no scary surprises, no HMRC investigation, and no sleepless nights worrying about your taxes. Don't be afraid to ask for help.

One of the best things you can do for your business and your peace of mind is to find a good tax accountant, especially one who knows what it's like to be an OnlyFans creator. They can help you plan your taxes and make sure you pay them all. And if you're looking for a reliable way to promote your OnlyFans account, OnlyTraffic can help you do just that.